“maternity And Parental Insurance Benefits: A Look At Europe’s Support Systems” – You work hard to reach your financial goals, working countless hours at the office to support your family and grow your retirement savings, but are you really making enough to save the effort?

It’s easy to forget about the importance of your financial protection when you’re busy raising your family and doing everything you can to build your retirement nest egg.

“maternity And Parental Insurance Benefits: A Look At Europe’s Support Systems”

Having the right health insurance for your family, among other important tips, will help you enjoy the fruits of your labor. After all, it only takes one accident or major illness to wipe out everything in your family.

Maternity And Paternity Leave Around The World In 2023

It’s not easy to admit, but even young and seemingly healthy people often have life-changing accidents and illnesses.

An article today reported a 60% increase in skin cancer rates in patients under 50 years of age and a doubling of colon cancer rates in patients under 50 years of age. Although a healthy lifestyle can help reduce the risk of such diseases, no one can give a complete guarantee. They suffer.

The first thing you should do is review your family insurance policies to ensure that your family is adequately protected against financial problems arising from unforeseen circumstances.

There is a common assumption that having one or more insurance policies will protect you completely from the unexpected. The real question you should ask yourself is whether you have enough insurance in case of an accident or serious health problem. One way to figure this out is to calculate your savings gap.

Compare And Understand The Best Maternity Insurance In Singapore

If your remaining number is negative, you will have a gap in your family protection. This means that they will not have enough money to cover them after your death or even if you recover from a serious illness.

Insurance costs money, but you don’t have to think about it because your savings can cost more than you think. If you are not sure whether you have the money to increase the security of your current policies, the first step is to do a cash flow analysis.

To find this, subtract all of your monthly expenses (rent, utilities, insurance premiums, etc.) from your mortgage payment. If your outgoings are not enough to support the insurance that fills the protection gap, you need to review your spending habits and make necessary changes like eating less. .

Here are the main types of insurance that most families need to protect family finances from unexpected events.

Maternity And Parental Leaves

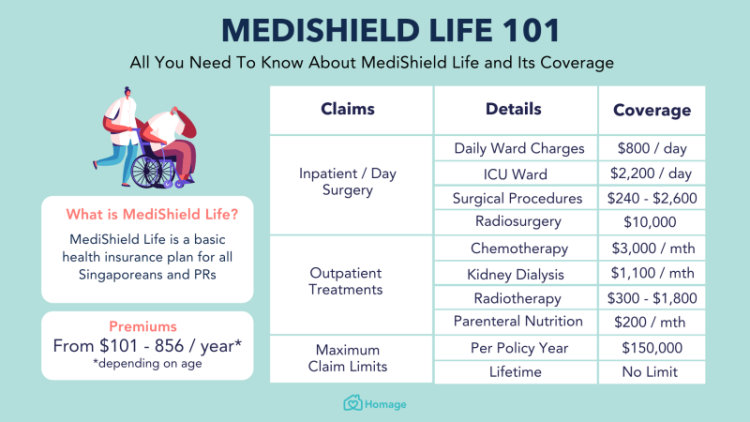

Health insurance covers medical expenses (such as hospital bills) in the event of injury, illness or disability. In Singapore, everyone can get basic health insurance through MediShield Life, which provides basic assistance to reduce out-of-pocket expenses for large medical bills in B2 and C wards of public hospitals. Also, its annual claim limit is $100K.

But did you know that you can increase the coverage offered by MediShield Life by purchasing an Integrated Shield Plan (IP) like Better Shield from a private insurer? It covers the pre- and post-hospitalization expenses and allows you to join either the A category of government hospitals or private hospitals. Plus, you get an annual bonus of $1 million or more.

While you may not think that health insurance is important only for the dependent(s), it is also important to have adequate coverage for all dependents in the family, including children and grandparents, as anyone may need medical care at any time. Family Income

The main purpose of life insurance is to provide financial peace of mind to your loved ones by providing cash payouts in the event of critical illness, disability (which may lead to disability) or death.

Parental Leave In Ontario Faq

As a parent, it is important to have life insurance to protect your children and their happiness. If something were to happen to one or both parents, a payout on a life insurance plan would act as a protective tool, minimizing the impact on your child’s enjoyment of life and making life as stable as possible, even during difficult times. .

Depending on the severity of the illness or condition, not receiving this money means choosing between need and “maybe” and putting off things that make your child happy. Such a situation may go far in the future, as the financial condition of the family gradually deteriorates or requires long-term treatment.

Even if you have two families in your family, life insurance is important because the loss of your spouse makes it twice as difficult to manage the other person’s household expenses and maintain your family’s standard of living.

For families with one parent staying at home to care for children or elderly grandparents, it is important to protect both parents, as it can be expensive to find other options such as childcare or aides.

Division Of Temporary Disability And Family Leave Insurance

Health insurance covers hospitalization, surgeries and medical expenses of covered patients. But that money only pays for medical expenses. Critical Insurance (CI) is highly recommended for dependent(s) as it is not limited to treatment but provides payment on diagnosis of critical illness which means daily income can be used to cover your living expenses. Replacement during recovery.

You can also consider adding a dreaded disease rider to select insurance plans such as a whole life or savings plan. If you are diagnosed with a serious illness during the rider period (excluding angioplasty and other coronary artery treatments), you will be paid a guaranteed rider fee to focus on treatment to help you get better.

Private health insurance doesn’t provide the financial support you need to cover your day-to-day expenses, so it’s a huge advantage to avoid dipping into your hard-earned money.

Personal accident insurance (PA), like PA insurance, is designed to provide a payout amount in the event of serious injury, disability or death due to an accident, an amount that helps cover certain losses. from damage. This Act also covers medical expenses.

Protect Your Loved Ones With The Right Family Insurance Policies

PA groups are especially useful because children and the elderly are prone to falls.

The amount of insurance your family needs usually depends on various factors such as your occupation, jobs, lifestyle and number of dependents. While choosing insurance policies, it is recommended not to spend more than 10% of your monthly budget on insurance.

Let’s see how much the major insurance policies and projects that John and his family need will cost.

John pays for insurance for himself, his wife, two children and two elderly parents. He opted for Better Shield for all plans, including treatment in private hospitals. Part of the premiums paid by MediSave (assuming all John’s family members are Singapore citizens or PRs and John has enough money in his Medisave account), John will qualify for family health insurance this year. Premium. For:

Employment Insurance Improvements

As the family depended on them for their monthly payments, John purchased Star Term Protection for himself and his wife with a sum assured of 150,000 and cover for death, terminal illness and total and permanent disability up to the age of 64. It comes to them:

To protect him from accidents and diseases that cause him to play football on weekends and send his children to school, John takes out insurance against infections for himself and his two children. That’s $219.03 per year for John and $131.41 per year for each child.

John knew that as his parents got older, they would fall more often and need more care, so he had SilverCaperersonal insurance plans for both of them. Because it applies to each when they turn 60, the original plan would have paid each parent $162 a year.

In addition to “needs”, there may be other important needs to protect your family. For example, newlyweds can look for home and maternity insurance. For those with large families, they may want to consider auto insurance and home insurance. And of course, families going on vacation always need travel insurance. Here’s a quick look:

Taiwan Increases Maternity And Paternity Leave

Home insurance is designed to protect items in your home (furniture, televisions, etc.) and pay for repairs if they are damaged due to water damage, fire, theft, vandalism, and other causes. politics

Car insurance is mandatory in Singapore and protects your car against incidents such as theft or accidents or vandalism or vandalism. It also protects you from liability and legal claims in an accident caused by you

Parental and maternity leave, maternity and parental benefits, benefits of decision support systems, king support systems insurance services, insurance with maternity benefits, health insurance with maternity benefits, benefits of clinical decision support systems, clinical decision support systems benefits, employment insurance maternity and parental benefits, health insurance for maternity benefits, maternity support belt benefits, maternity benefits insurance